- This topic has 28 replies, 9 voices, and was last updated 5 months ago by

MFillingham.

MFillingham.

- CreatorTopic

- May 3, 2025 at 11:03 pm#305070

Some time ago I wrote that Motability granted me early termination of my current EV on mechanical grounds and I even placed an order for a new EV. But when I heard Elon Musk is going back to Tesla I cancelled my order.

This post is to ask your opinions (PLEASE, refrain from any political comment to ensure this discussion will benefit the members of the forum) on how you see the short term future of the EV market in general and models which are or may come on Motability in June / September this year.

Here is why I think (hope?) the prices will decline within a number of months:

1. Chinese EV cars are gaining momentum in the UK, forcing competitors to reduce their prices.

2. Despite the government’s efforts, if you cannot charge at home for circa 7p per kWh, owning EV is more expensive than ICE (public charging points, except Tesla, charge you over 70p)

3. Elon Musk is no stranger to cutting prices – he did it in the past, despite all the complaints from those who placed orders and paid higher price, and I think he may do it again, once back. It is already possible to get brand new Model Y with 2.9% APR or a new / nearly new Model Y with 0% APR.

4. The government recently introduced EV VED charges – less incentive to by EV.

5. The government has also introduced BiK changes – within less than just two years, in 2027, it will reach 5% and in 2029 – 9%. Again – less incentive to by EV.

6. Oil price – despite dollar’s slide since Trump came to power, the Brent is still below $62 mark, signalling to me that the oil price will continue to decline, and prices at the petrol station will follow the suite.Sent from a mobile device.

Apologies for briefness and spelling mistakes.Motability Skoda Enyaq SportLine 85x April 2024 (unhappy customer - Ombudsman pending)

Motability Mazda CX-60 July 2023 (unhappy customer - early termination on mechanical grounds)

Motability VW Touran Family Pack May 2019 (happy customer) - CreatorTopic

- AuthorReplies

- May 4, 2025 at 7:56 am #305071

Leaving aside the fact that I don’t understand the logic behind why you would cancel your EV order because Elon Musk is going back to Tesla – when Tesla’s aren’t even on the scheme……

I agree that EV prices will have to drop in order to improve take up levels, but whether that will happen in the next few months is possibly optimistic. It is true that the arrival of a new wave of Chinese EVs will certainly put pressure on European manufacturers, although given the general poor quality and lack of longevity of many other Chinese made consumer goods, it remains to be seen whether U.K. consumers will embrace them in vast numbers. Fleet users (who form the vast majority of EV consumers) may be inclined to stick with brands that they know and love and, as we know, private buyers, who may be more inclined towards a budget priced product, aren’t embracing EVs.

I also don’t think it’s a given that lower up front costs will, in itself, get the EV market to where it needs to be, as this is only one of the issues that is stopping private buyers from embracing them. Concerns remain over low residual values, high insurance costs, range limitations (especially in winter), real range versus claimed range, concerns over battery degradation over time and cost (and viability) to replace (I don’t think that this is an issue now, but concerns remain), not to mention the biggest elephant in the room that, as you say, if you can’t charge at home (which tens of millions can’t) then it will cost more to run than an economical ICE car. Plus, of course, there’s the longer term question mark over how governments will recoup the lost fuel revenues (which they will have to do) and whether that will result in some form of charge per mile driven, which ultimately would challenge EVs biggest current advantage (lower running costs if you can charge at home).

The simple fact remains that market demand for EVs is not tracking the ZEV target trajectory and the recent minor softening of them isn’t going to address that. I remain of the view that as each year goes by, whichever government is in power at the time will finally have to wake up to the fact that you can set all the targets that you like, but you cannot force consumers to buy something that they simply don’t want!

May 4, 2025 at 8:20 am #305074you cannot force consumers to buy something that they simply don’t want!

Very true. Unless the price is right, maybe?? The 2024 ZEV 22% target was missed which came in at 19.6%, close, but no cigar. Source: Drive Electric

I don’t quite understand the Tesla bit @kdwolf as they are not on the scheme. Personally, I wouldn’t touch one. And a Chinese one would have to be a very attractive AP.

Skoda Enyaq Race Blue

May 4, 2025 at 8:40 am #305077Some time ago I wrote that Motability granted me early termination of my current EV on mechanical grounds and I even placed an order for a new EV. But when I heard Elon Musk is going back to Tesla I cancelled my order. This post is to ask your opinions (PLEASE, refrain from any political comment to ensure this discussion will benefit the members of the forum) on how you see the short term future of the EV market in general and models which are or may come on Motability in June / September this year. Here is why I think (hope?) the prices will decline within a number of months: 1. Chinese EV cars are gaining momentum in the UK, forcing competitors to reduce their prices. 2. Despite the government’s efforts, if you cannot charge at home for circa 7p per kWh, owning EV is more expensive than ICE (public charging points, except Tesla, charge you over 70p) 3. Elon Musk is no stranger to cutting prices – he did it in the past, despite all the complaints from those who placed orders and paid higher price, and I think he may do it again, once back. It is already possible to get brand new Model Y with 2.9% APR or a new / nearly new Model Y with 0% APR. 4. The government recently introduced EV VED charges – less incentive to by EV. 5. The government has also introduced BiK changes – within less than just two years, in 2027, it will reach 5% and in 2029 – 9%. Again – less incentive to by EV. 6. Oil price – despite dollar’s slide since Trump came to power, the Brent is still below $62 mark, signalling to me that the oil price will continue to decline, and prices at the petrol station will follow the suite.

1. As you state yes the Chinese are forcing down the prices a good thing for all of us.

2. Have you not read the posting North West to Cornwall, cheaper than a PHEV, HEV or ICE.

6. Oil price also affect the price of electricity.

As regards Elon Musk and Tesla I cannot see you problem. The market will sort itself out, at the moment there is plenty of desirable EV’s on the used market at bargain prices, fancy a Polestar 2 less then £20,00 with Polestar 2 year warranty.

Unfortunately I have suffered a brain injury and occasionally say the wrong thing.

May 4, 2025 at 9:16 am #305079you cannot force consumers to buy something that they simply don’t want!

Very true. Unless the price is right, maybe?? The 2024 ZEV 22% target was missed which came in at 19.6%, close, but no cigar. Source: Drive Electric I don’t quite understand the Tesla bit @kdwolf as they are not on the scheme. Personally, I wouldn’t touch one. And a Chinese one would have to be a very attractive AP.

I see my Tesla bit confused some. In my personal view Tesla still drives the market, as they do not patent any of their solutions. I don’t expect Tesla will be on Motability, but their pricing model will definitely impact the market as it happened in the past.

When Model Y Long Range was reduced by £5,000 to £52,990, Mustang responded by drop of £7,000, VW – by several thousands, etc.

Sent from a mobile device.

Apologies for briefness and spelling mistakes.Motability Skoda Enyaq SportLine 85x April 2024 (unhappy customer - Ombudsman pending)

Motability Mazda CX-60 July 2023 (unhappy customer - early termination on mechanical grounds)

Motability VW Touran Family Pack May 2019 (happy customer)May 4, 2025 at 9:19 am #305080As regards Elon Musk and Tesla I cannot see you problem. The market will sort itself out, at the moment there is plenty of desirable EV’s on the used market at bargain prices, fancy a Polestar 2 less then £20,00 with Polestar 2 year warranty.

Yes, I am monitoring Jaguar I Pace – pre-reg HSE trim now dropped below £39,000 from £44,000 for 25 model. But cannot afford it unless they will offer 0% APR for tens of cars they still have in stock.

Sent from a mobile device.

Apologies for briefness and spelling mistakes.Motability Skoda Enyaq SportLine 85x April 2024 (unhappy customer - Ombudsman pending)

Motability Mazda CX-60 July 2023 (unhappy customer - early termination on mechanical grounds)

Motability VW Touran Family Pack May 2019 (happy customer)May 4, 2025 at 9:57 am #305082The 2024 ZEV 22% target was missed which came in at 19.6%, close, but no cigar. Source: Drive Electric

Now that the targets are starting to really tick up, I can see the yearly shortfalls increasing – massively. Early adopters have adopted and most fleet users who want to switch for tax reasons will have already done so, so those two groups (who make up the vast majority of EV drivers) will be renewing EVs, rather than switching to them. For the percentages to increase substantially it will become increasingly dependent on private buyers switching.

Whilst EVs are incredibly popular amongst contributors to this forum, I always think that it’s important to remember that we are not representative of the majority. First and foremost, we are not having to buy our cars, and I’ve already mentioned some of the barriers that are stopping private buyers from buying EVs. Secondly, many Motability customers are on low incomes (perhaps even just benefits) and cheap running costs will have a disproportionately high importance over other factors.

I find it very interesting that of my wide circle of family and friends (none of whom are disabled and all are in employment or on private pensions), only one person has an EV (my nephew – and he can’t wait to go back to a petrol car when his lease is up as he cannot charge at home and the novelty of public charging has well and truly worn off) and only one has a PHEV (me)! Even though the overwhelming majority of the others would be able to charge off road, none of them is interested in an EV, even if it would save them money. Not only are they not interested but they actively wouldn’t want one. That’s why I feel confident in saying that the targets remain unachievable. Of course, if this weeks local elections were to be replicated at the next general election, the ZEV targets wouldn’t be softened – they’d be completely scrapped! Stranger things have happened. Voters don’t like being told that they must do things that they don’t want to do!

May 4, 2025 at 10:19 am #305083Tesla sales have all but collapsed in europe. In Sweden, Tesla’s new car sales in April plunged 80.7% to their lowest since October 2022. Its sales in the Netherlands fell 73.8% to their weakest for that month since 2022 and were down 33% in Portugal, a bigger drop than the previous month. Sales in Denmark dropped 67.2%, data showed on Thursday, while France reported a 59.4% fall. This compared to an overall market slump of 7.3%

Despite this there has been and unlikely to be no price war due to the Musk factor, which is the cause. Despite this, Tesla’s are made in its Chinese gigafactory, which will further impact the brand, when Musk steps down from the Whitehouse completely, as tariffs will start to bite in America. There were/are talks to replace Musk at Tesla, which has ben denied at Tesla board of chairmen however, it may be the logical solution.

In the meantime reports state EUrope are turning to Chinese manufacturers where they have a far better selection of Chinese cars than we do in the UK.

May 4, 2025 at 10:37 am #305085I see my Tesla bit confused some. In my personal view Tesla still drives the market, as they do not patent any of their solutions.

You can of course believe whatever you want, that doesn’t make it correct.

This is of course wrong on all levels. Tesla does hold thousands of patents, and the actual “idea” that Musk was perpetuating was nothing more than a marketing stunt, designed in such bad faith that not a single car maker even contemplated looking at the patents.

I’d suggest you read into the actual “idea” of Musk. Because i can almost guarantee that you have not.

Tesla’s agreement not to sue a party for patent infringement extends only “for so long as such party is acting in good faith.” The Pledge goes on to state that a party is acting in good faith as long as they have not:

asserted, helped others assert or had a financial stake in any assertion of (i) any patent or other intellectual property right against Tesla or (ii) any patent right against a third party for its use of technologies relating to electric vehicles or related equipment;

[..]

Glos Guy seems to have a legal knack, he should be able to understand what this means and why no company would even remotely contemplate that pledge, after just the first of three obligations.

It means that if you use a Tesla patent, any other car maker (not just Tesla) is allowed to use any of your patents without repercussion. Even better: Tesla also gets to use all of your intellectual property, too.

Here’s a good summary as to why this “all our patents are belong to you” is a complete non-starter. And i mean, they’d laugh you out of the door if you suggested even looking at this in a board meeting. And then probably fire you, too.

Prior: SEAT Ateca Xcellence Lux 1.5 TSI DSG MY19, VW Golf GTE PHEV DSG MY23

Current: Hyundai Ioniq 6 Ultimate

Next: we'll see what's available in 2028.May 4, 2025 at 12:08 pm #305090Here’s my thoughts.

Tesla is, unfortunately, still relevant as every media reviewer will compare against the relevant model. If they dropped £5k off a price that would make a huge difference to prices for other manufacturers models that did compete. If that happens then the resale value drops further and Motability are currently looking at rather depressing resale values.

The media are looking at second hand EVs. I’ve seen more articles about ownership of used EVs and the reliability towards and beyond the 8 year/100,000 mile age. As communication improves around ownership of used EVs then that market will improve. Again, as more people have older EVs and don’t have major issues, then others will see that the old stories of batteries needing expensive replacement just as the warranty runs out aren’t so true.

There are some nice cars hitting the market that aren’t yet on scheme and could be if the manufacturer wants the numbers. KIA, for example, have a number of really nice EV models that are genuinely built as EV which makes for the best EV experience. They aren’t offering much on the scheme but if they work out that sticking all EV* models on the scheme will improve their balance and get them either close to or over quotas.

For people seeking smaller cars, that seems to be the direction the market is taking over the next year, with a lot of city cars coming in under retail of £20-25k and some even targeting the teens. If space isn’t your requirement, these could see zero APs and less than full benefit on an EV.

Citroen are looking at updating their models this year, following Peugeot’s and Vauxhall’s updates there will be their versions of the 2008,3008,5008 released.

I'm Autistic, if I say something you find offensive, please let me know, I can guarantee it was unintentional.

I'll try to give my honest opinion but am always open to learning.Mark

May 5, 2025 at 1:23 am #305108Naturally with the flood of cars coming (and due to continue coming) from China I only see EVs getting cheaper and cheaper, but it won’t be quick.

Can’t wait to get my first EV delivered from the scheme. Will be saving £300+ a month in fuel by charging at home – people often forget these huge savings when taking into account the upfront cost of an EV. Thanks to this benefit my lease effectively becomes nearly “free”.

£5 to charge at home or £60+ for a tank of fuel. EV ownership is a no brainer if you can charge at home. If you can’t I’d argue it’s rubbish due to insane public charging prices.

No matter how cheap Brent Crude gets you won’t see petrol drop more than 20p a litre which isn’t even worth thinking about really.

May 5, 2025 at 8:42 am #305118Naturally with the flood of cars coming (and due to continue coming) from China I only see EVs getting cheaper and cheaper, but it won’t be quick.

Can’t wait to get my first EV delivered from the scheme. Will be saving £300+ a month in fuel by charging at home – people often forget these huge savings when taking into account the upfront cost of an EV. Thanks to this benefit my lease effectively becomes nearly “free”. £5 to charge at home or £60+ for a tank of fuel. EV ownership is a no brainer if you can charge at home. If you can’t I’d argue it’s rubbish due to insane public charging prices. No matter how cheap Brent Crude gets you won’t see petrol drop more than 20p a litre which isn’t even worth thinking about really.

Blimey. £300+ a month on fuel? You must be an extremely high mileage driver and/or have an extremely fuel inefficient car? My previous petrol car (2.0i BMW) was costing me around £120 a month in petrol and that was for around 10,000 miles a year!

There is no doubt that if you can charge at home an EV will be considerably cheaper to run but, presumably, if you are a very high mileage driver (I’m guessing you must do at least 25,000 miles a year?) then you probably do a lot of long journeys and will therefore be charging on public chargers as well? Also, as I’m sure you know, a full charge at home won’t give you anywhere near as many miles as a refuel of an ICE car. I’ve had several ICE cars that easily do 600+ miles between fill ups!

My simple point is that whilst an EV that can be charged at home will always be a lot cheaper to run (at least until the government introduce something like pence per mile charges to make up for the lost fuel duty), very few Motability customers do the sort of mileage that you do, so whilst they will undoubtedly save money, it won’t be of the same scale as you and therefore won’t result in a ‘free’ lease once you take into account the AP and the £12,000 sacrificed benefits.

May 5, 2025 at 8:54 am #305119Here’s my thoughts. Tesla is, unfortunately, still relevant as every media reviewer will compare against the relevant model. If they dropped £5k off a price that would make a huge difference to prices for other manufacturers models that did compete. If that happens then the resale value drops further and Motability are currently looking at rather depressing resale values. The media are looking at second hand EVs. I’ve seen more articles about ownership of used EVs and the reliability towards and beyond the 8 year/100,000 mile age. As communication improves around ownership of used EVs then that market will improve. Again, as more people have older EVs and don’t have major issues, then others will see that the old stories of batteries needing expensive replacement just as the warranty runs out aren’t so true. There are some nice cars hitting the market that aren’t yet on scheme and could be if the manufacturer wants the numbers. KIA, for example, have a number of really nice EV models that are genuinely built as EV which makes for the best EV experience. They aren’t offering much on the scheme but if they work out that sticking all EV* models on the scheme will improve their balance and get them either close to or over quotas. For people seeking smaller cars, that seems to be the direction the market is taking over the next year, with a lot of city cars coming in under retail of £20-25k and some even targeting the teens. If space isn’t your requirement, these could see zero APs and less than full benefit on an EV. Citroen are looking at updating their models this year, following Peugeot’s and Vauxhall’s updates there will be their versions of the 2008,3008,5008 released.

Talking about Tesla have you seen the used market insane prices for a 4/5 year old Tesla with 60,000 miles on the clock, if they don’t extend my lease I many seriously consider a used Tesla.

Unfortunately I have suffered a brain injury and occasionally say the wrong thing.

May 5, 2025 at 9:28 am #305121Naturally with the flood of cars coming (and due to continue coming) from China I only see EVs getting cheaper and cheaper, but it won’t be quick.

Can’t wait to get my first EV delivered from the scheme. Will be saving £300+ a month in fuel by charging at home – people often forget these huge savings when taking into account the upfront cost of an EV. Thanks to this benefit my lease effectively becomes nearly “free”. £5 to charge at home or £60+ for a tank of fuel. EV ownership is a no brainer if you can charge at home. If you can’t I’d argue it’s rubbish due to insane public charging prices. No matter how cheap Brent Crude gets you won’t see petrol drop more than 20p a litre which isn’t even worth thinking about really.

Blimey. £300+ a month on fuel? You must be an extremely high mileage driver and/or have an extremely fuel inefficient car? My previous petrol car (2.0i BMW) was costing me around £120 a month in petrol and that was for around 10,000 miles a year! There is no doubt that if you can charge at home an EV will be considerably cheaper to run but, presumably, if you are a very high mileage driver (I’m guessing you must do at least 25,000 miles a year?) then you probably do a lot of long journeys and will therefore be charging on public chargers as well? Also, as I’m sure you know, a full charge at home won’t give you anywhere near as many miles as a refuel of an ICE car. I’ve had several ICE cars that easily do 600+ miles between fill ups! My simple point is that whilst an EV that can be charged at home will always be a lot cheaper to run (at least until the government introduce something like pence per mile charges to make up for the lost fuel duty), very few Motability customers do the sort of mileage that you do, so whilst they will undoubtedly save money, it won’t be of the same scale as you and therefore won’t result in a ‘free’ lease once you take into account the AP and the £12,000 sacrificed benefits.

Taking an average of £10 for 60 miles, means your covering 1,800+ miles a month, 21,600 miles a year, 64.800 miles over a 3 year lease, leaving you excess mileage of 4,800 on a 3yr 60,000 miles lease?

May 5, 2025 at 10:33 am #305126Thank you all for commenting on my thread – very interesting discussion.

1. I myself drive over 20,000 pa. This year ended up with 26,000. Winter or summer, the big battery is sufficient and beyond for doing 90 miles a day for two days in a row, and then to charge at home, using the wall charger. I only use public charging points when we go to see family at Newcastle all the way from the South West or when drive to the continental Europe e.g. to Menin Gate at Ypres (to the Memorial of the British and Commonwealth solders).

2. I didn’t know in the UK we use oil to generate electricity – I always thought it was good old coal replaced later with gas turbines (in addition to the renewable energy buzzwords).

3. I agree Tesla is still very relevant and the fact they have open-source patent approach, philosophically similar to Apache 2.0 license, encouraging open innovation, will keep their position as a visionary. And as a result – when Tesla will reduce their price again, everyone else will.

4. I am on a EV market since my first 65 reg plate – we took Renault Zoe with zero deposit, 12,000 miles pa for £172. They even installed the wall charger for free. Then a number of years later Zoe appeared on Motability with over £4,000 AP. That was laughable. So yes, I do think the prices for EV will significantly decline within a month or two, with Musk returning to lead Tesla.

Sent from a mobile device.

Apologies for briefness and spelling mistakes.Motability Skoda Enyaq SportLine 85x April 2024 (unhappy customer - Ombudsman pending)

Motability Mazda CX-60 July 2023 (unhappy customer - early termination on mechanical grounds)

Motability VW Touran Family Pack May 2019 (happy customer)May 5, 2025 at 11:18 am #3051292. I didn’t know in the UK we use oil to generate electricity – I always thought it was good old coal replaced later with gas turbines (in addition to the renewable energy buzzwords).

Oil fired power plants burn oil to heat water and produce steam, which then turns turbines to produce electricity. Not sure if UK does this anymore but, we had aound 12 such plants during the mid 2010’s.

May 5, 2025 at 12:02 pm #305133@kdwolf As this is a Motability forum, can I just check that when you say that you think that EV prices will “significantly decline over the next month or two”, are you referring to the retail prices, or the Advance Payments (APs) for them through Motability?

The reason that I ask is that I don’t think that one will necessarily follow the other! To explain, Motability have taken a massive hit due to plunging EV residual values – and that’s with most of the current EV fleet being ‘known’ brands, where second hand customers could be expected to be more confident of making a purchase. Motability’s increasing exposure to the EV residual market has been one of the main drivers behind the across the board rise in APs.

We are starting to see the beginnings of a flood of unknown, often Chinese, brands which will undoubtedly be cheaper from a retail selling price, but could well suffer crippling depreciation. If retail customers are shunning second hand EVs from known brands, only time will tell what the demand will be when these cars hit the second hand market. I’d suggest that leasing companies such as Motability are likely to take a cautious approach regarding anticipated residual values, and therefore even though these cars may drive retail prices down, this won’t necessarily result in lower APs – at least initially.

-

This reply was modified 5 months ago by

Glos Guy.

Glos Guy.

May 5, 2025 at 12:18 pm #305135@Glos_Guy I can’t see APs coming down until second hand prices stabilise.

What we’ve seen, in terms of used prices, over the last 5 years is highly unusual. With Covid and the following chip supply problems 3 year old cars weren’t far from brand new prices, year old cars were usually making a profit over new. Then, once supply caught up, there was a correction. Somehow that correction was misinterpreted into a lack of confidence and used EV prices fell to pretty much ridiculous levels. We went from small losses after 3 years to 50% to, in some cases, 75% reductions in 3 years. That perceived lack of confidence has, kind of, become a self fulfilling prophecy, as nobody wants to buy a car that could be worthless after a further 3 years. Then there’s that whole 7/8 year high voltage warranty issue, where nobody really has significant evidence of an 8 year old EV having a decent battery capacity, not helped by current 8 year old EVs having a WLTP range below 200 miles when new. What was expected was a further correction back to the usual 3 year depreciation levels, it’s unclear whether all EVs are there yet.

Without the Tesla price dropping problem, the future value isn’t certain just yet, so Motability will price conservatively (from their point of view) for the foreseeable future. Tesla has a tendency of increasing demand by price dropping in significant amounts. That automatically impacts used prices and could further cause Motability issues.

So, while there are cheaper new retail prices and some competition and quota pressures on these prices, used prices won’t be raising any time soon.

I'm Autistic, if I say something you find offensive, please let me know, I can guarantee it was unintentional.

I'll try to give my honest opinion but am always open to learning.Mark

May 5, 2025 at 1:40 pm #305136Well put @MFillingham

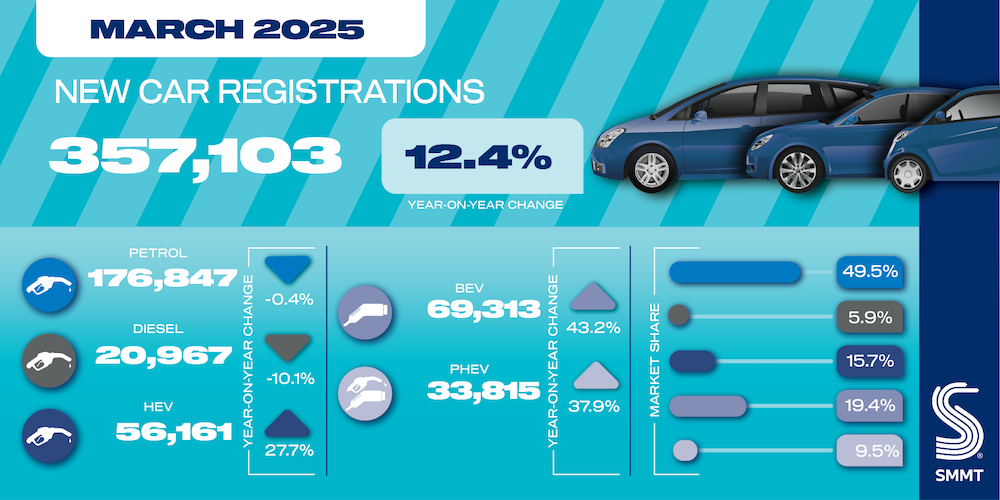

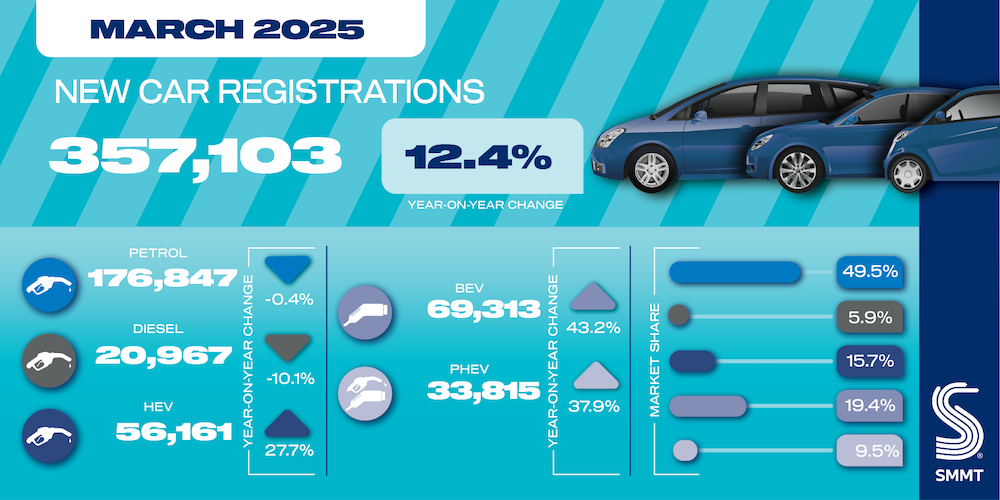

It seems as though there is significant disinformation and FUD being spread in the media regarding the sale of EVs. The SMMT (Society of Motor Manufacturers and Traders) New Car registration figures for March 2025 show a 43.2% increase in EV sales year on year.

May 5, 2025 at 1:56 pm #305138

May 5, 2025 at 1:56 pm #305138@Zero1 Keep in mind that the 43% increase is against a very low base. The more relevant figures are what percentage of new cars were EVs (20% – so only one in every 5 new cars sold) and what percentage of cars on our roads are currently EVs (4%). This is why the ZEV mandates remain unachievable!

May 5, 2025 at 2:02 pm #305139Well put @MFillingham It seems as though there is significant disinformation and FUD being spread in the media regarding the sale of EVs. The SMMT (Society of Motor Manufacturers and Traders) New Car registration figures for March 2025 show a 43.2% increase in EV sales year on year.

Source SMMT

“While EV market share improved significantly on March 2024, at 19.4% it remains more than eight percentage points behind targets set by the ZEV Mandate. Furthermore, given the VED Expensive Car Supplement can now apply to eligible new EVs from 1 April – potentially raising ownership costs for most EV drivers by more than £2,000 over the next six years – the March EV performance will have been boosted by shrewd buyers seeking to get ahead of the taxation increase3. This underscores the challenge facing manufacturers whose 2025 EV sales must accelerate to 28% share over the course of the year. ”

Whils’t Fleet still remain by far the largest buyers of BEV’s, an artificial blip occured in March with private sales, as buyers chose to beat the introduction of VED, as outlined above. More realistic BEV still retain less than 20% share of the overall market.

May 5, 2025 at 2:53 pm #305142@kdwolf As this is a Motability forum, can I just check that when you say that you think that EV prices will “significantly decline over the next month or two”, are you referring to the retail prices, or the Advance Payments (APs) for them through Motability?

I think that we will be facing another significant drop in EV prices on the open market, which will positively impact Motability APs, yes. Hence raised this topic to have other people’s opinions.

Polestar 4 as an example – it is a Chinese car, despite some think it comes from Sweden. It is reasonable to assume it does not cost more than £30,000 to mass produce this vehicle, but it sold from circa £60,000 onwards.

Import duty – 10%, Shipping, insurance – £1,500 (remember it is on the industrial level, so costs per car are low), VAT 20%, so total cost on British soil is £41,400.

Polestar operate DTC model (same as Tesla) – Direct To Consumer, so it is reasonable to assume they won’t loose money even if they will drop the price by several thousands. Tesla, as oppose to someone who advised here, is not manufactured in China, but in Europe : Tesla’s VIN numbers in the UK begin with XP7.

Same goes to BMW iX3 – made in China (Dadong), DS9 saloon built in China. Even Smart 1 and 3 are built in China.

Sent from a mobile device.

Apologies for briefness and spelling mistakes.Motability Skoda Enyaq SportLine 85x April 2024 (unhappy customer - Ombudsman pending)

Motability Mazda CX-60 July 2023 (unhappy customer - early termination on mechanical grounds)

Motability VW Touran Family Pack May 2019 (happy customer)May 5, 2025 at 2:57 pm #305143@Glos Guy

Are the EV Mandates really unachievable? All the car manufacturers managed to meet the 22% mandate in 2024. It’s easy to quote meaningless figures regarding the percentage figures for EVs on UK roads….. In 2024 the average age of a car on UK roads was 9 years old. In 2015, 10 years ago, there were only 8 models of EVs available to buy, so out of the total of 34 million cars registered in the UK (April 2024) it’s obviously going to take some years for EVs to catch up in terms of total numbers.

Whilst I agree that the VED Expensive Car Supplement seems counterproductive to increasing EV sales, it is only applicable to EVs with a list price of £40,000 and above. Manufacturers have reduced the prices of many of their cars to make them exempt, in addition there are new EVs being introduced into the market with list prices below the £40k threshold. The changes have only levelled the playing field in VED costs between ICE and EV cars. For many people the increase can also be offset by the considerable savings which can be made in fuel costs by charging an EV at home on a discounted electricity tariff.

May 5, 2025 at 3:29 pm #305146Even Smart 1 and 3 are built in China.

Indeed Smart 1, EX30 etc are built in on the same factory as the Zeekr X and share the same Zeekr platform.

May 5, 2025 at 3:52 pm #305148Whilst I agree that the VED Expensive Car Supplement seems counterproductive to increasing EV sales, it is only applicable to EVs with a list price of £40,000 and above. Manufacturers have reduced the prices of many of their cars to make them exempt, in addition there are new EVs being introduced into the market with list prices below the £40k threshold. The changes have only levelled the playing field in VED costs between ICE and EV cars. For many people the increase can also be offset by the considerable savings which can be made in fuel costs by charging an EV at home on a discounted electricity tariff.

As, I understand maufacturers have only cut entry level cars, with upper trim models are still exceeding £40k. Of course there are Chinese and lower end often smaller european EV’s that top out under £40k anyway. Given EV’s are still more expensive than a equivulent or similar ICE/hybrid in the real world, you can still pick up a higher spec car for under £40k.

If you can charge at home and mainly drive with the range, savings can indeed be substantial but, if you can’t charge at home or do frequent journeys outside the range then the opposite is quite true.

May 5, 2025 at 3:53 pm #305149@kdwolf With respect, I don’t think that you are adequately considering how leasing costs work. Yes, EV retail prices are currently ludicrously high, but fleet operators (like Motability) are getting massive discounts at present, as they are the only route to getting adequate numbers into the market. I don’t disagree that retail prices will fall but, as already explained, there are several reasons why that won’t necessarily translate into lower APs, at least in the one to two months window that you are confidently predicting. A further reason could be that any big correction in retail prices could easily result in a softening of the huge discounts currently being offered to the likes of Motability, so one may offset the other. Let’s revisit this debate when the 1st June price list is released, as that fits perfectly with your time prediction, and see just how much the APs have been reduced.

@Zero1 Your 2024 ZEV figure is incorrect. The target was 22% (as you state) but the actual figure achieved was 19.6% This year the target is 28% and, as already discussed, March was only 20%. That means that the remaining year will need to be more like 30%. Then the targets go up 5% each year for the two years after, and then by 14% a year with a final hike of 20%. Let’s see what happens but if I was a betting man I’d put quite a chunk of money on those targets needing to be softened . -

This reply was modified 5 months ago by

- AuthorReplies

- You must be logged in to reply to this topic.